Northern Ireland’s economy has been outperforming the rest of the UK, and the labour market is recovering well from the Covid downturn. The economic outlook for NI is looking bright.

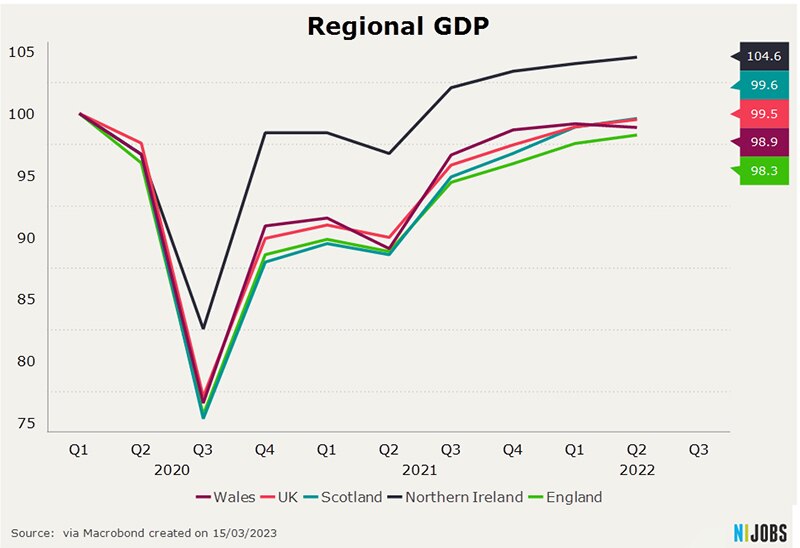

GDP Growth

With the Windsor framework, Northern Ireland (NI) is now the only region in the world that has access to both the EU common market and the UK and a hard border between NI and Ireland is avoided.

The benefits of remaining part of the EU common market are already visible when looking at a variety of economic indicators. Besides London, NI is the only region whose economic output is now exceeding its pre-pandemic level while all other regions in the UK have still not caught up to the 2019 level. Compared to Q1 of 2020, Northern Ireland’s GDP is now 4% higher.

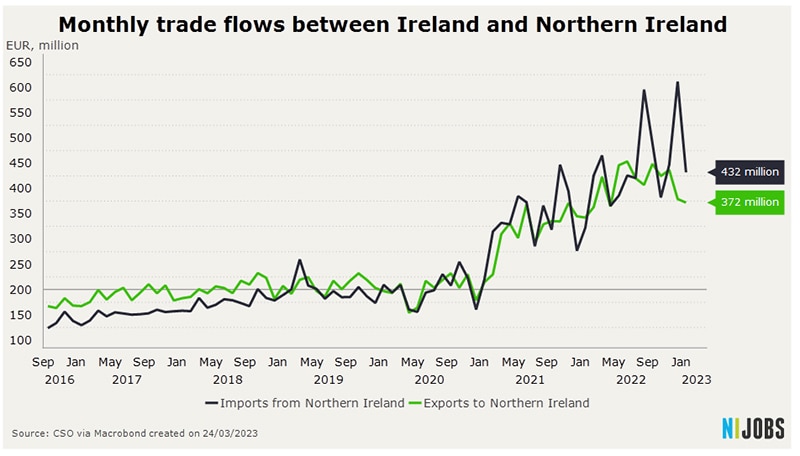

Trade diversion benefits Northern Ireland

The main advantage that Northern Ireland now enjoys is related to trade. Monthly trade flows between Northern Ireland and the Republic of Ireland have increased substantially in just a few years. Irish buyers have moved away from buying in Great Britain and are now buying from Belfast instead. Irish imports from NI have tripled since 2020, and exports to NI have doubled.

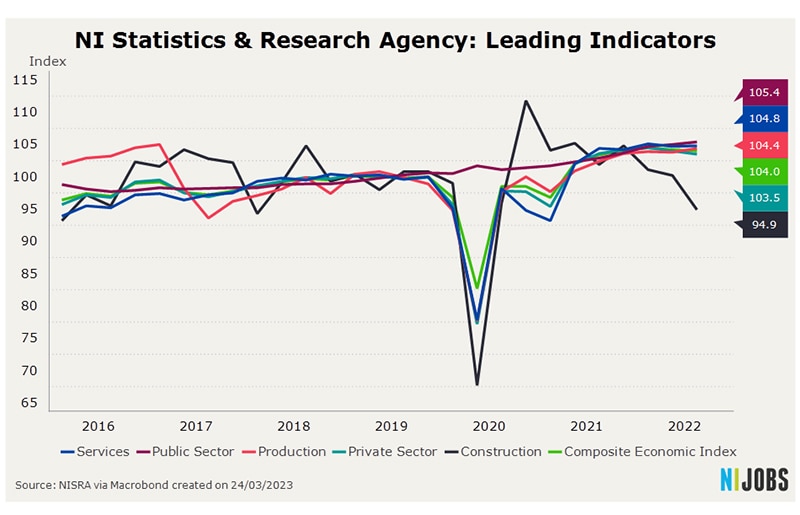

Economic sentiment is improving

Similar to the rest of the UK, economic sentiment in the region is improving as the economy is recovering the lost output from the pandemic.

The Northern Ireland Statistics and Research Agency is publishing several economic indicators that reflect economic activity across different sectors of the economy.

The composite economic index, a measure of GDP, has surged throughout 2021 and is currently several percentage points higher than in 2019. Services and production in NI have recovered quite well, and only construction is currently seeing a sharp downswing. That weakness is most likely a by-product of the BoE’s contractionary monetary policy stance to bring down inflation.

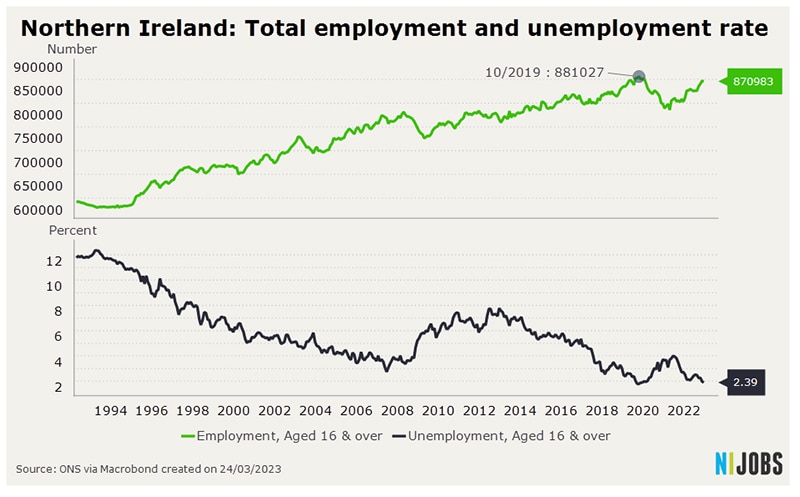

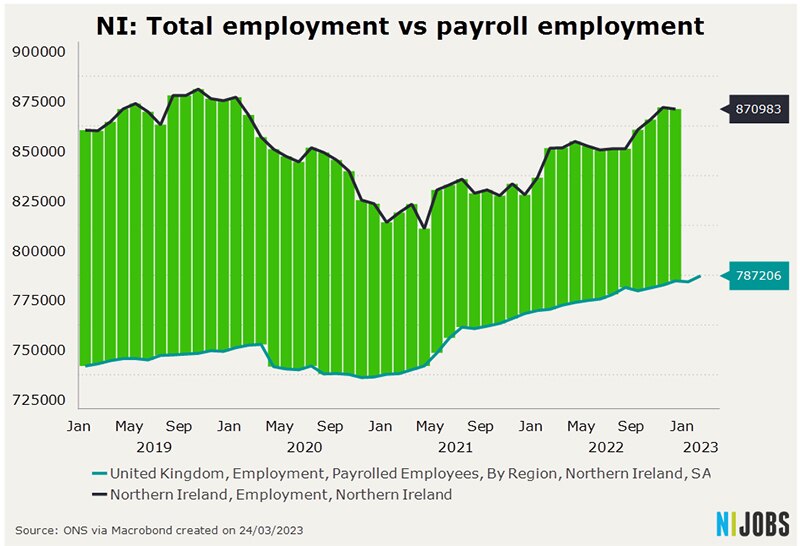

Total employment has not quite recovered, but payroll employment is way up

The labour market in Northern Ireland has also seen massive improvements in recent years. The unemployment rate has been on a downward trend for more than a decade and is now at an all-time low. Total employment is increasing but has not quite caught up to its pre-pandemic high.

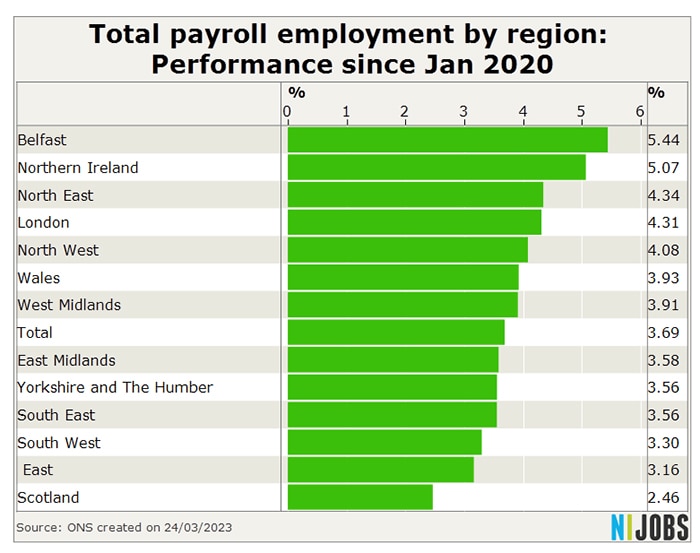

Payroll employment, on the other hand, has outperformed all other regions in the UK with payroll employment in Belfast and Northern Ireland in general up by more than 5% since January 2020.

The divergence between total employment and payroll employment can be explained by the decline in the number of self-employed during the early stage of the Covid pandemic.

Northern Ireland is one of the areas in the UK with a relatively high share of self-employment. Contract jobs, self-employment in construction and artistic jobs suffered a great deal during the lockdowns, and the total number of self-employed in the UK fell from more than 5 million to just 4.3 million last year. Some of these workers have left the labour force completely, while others tried to transition from self-employment to being employed. As the economy is now recovering from the pandemic recession, self-employment might also pick up again.

.

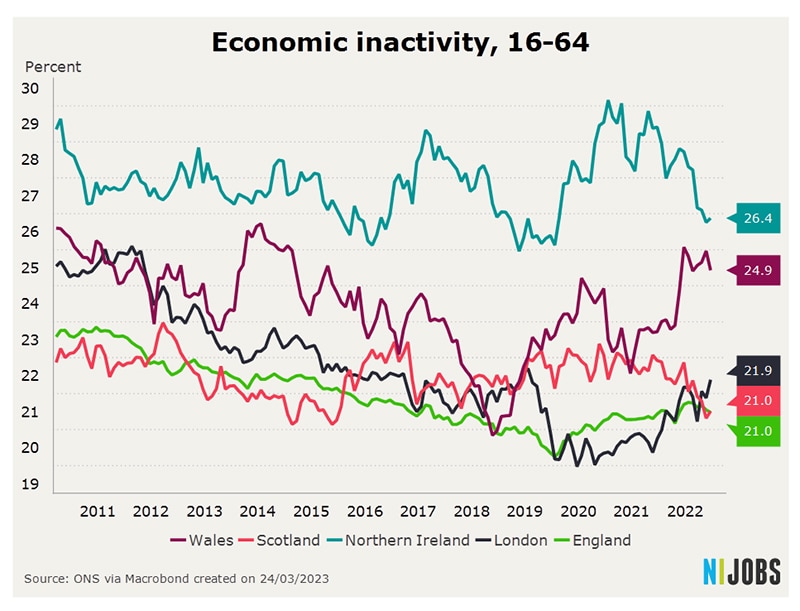

High economic inactivity is a drag on growth

One big area of concern for the Northern Irish labour market is the very high level of economic inactivity. In the UK, Northern Ireland has had the highest economic inactivity for many years by a wide margin. The good news is that inactivity has also been going down since 2020 on the back of a strong labour market recovery.

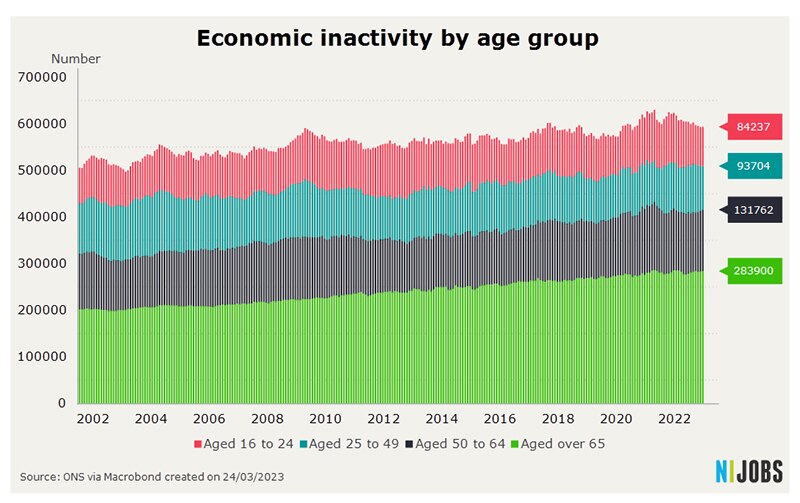

Looking at different age groups, it is mostly for those aged 50 to 64 and those aged over 65 that have seen an uptick in economic inactivity, so older workers who have left the labour force. Although the cost of living has prompted some older workers to return to the workforce, as NIJobs observed in its Job Report.

Given the long-run demographic outlook of advanced economies facing a stagnating or shrinking labour pool in the years to come, attracting and retaining older workers will be key crucial for businesses and future economic growth.

The UK government is aware of the situation and is preparing to target older workers to come back into the workforce

The housing market and regional integration across the island of Ireland

One of the biggest challenges that many advanced economies are facing is unaffordable housing, and the island of Ireland is no exception. The problem is mostly the result of policy rather than market failures. House prices in metropolitan areas have surged in recent decades as demand has outstripped supply. Large cities have the thickest labour markets and the largest availability of jobs, but housing policies have prevented to add more residential units in the places where they are needed the most.

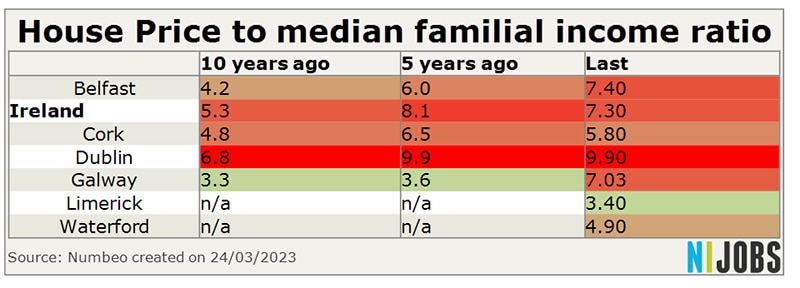

House price-to-income ratios have surged in recent decades, meaning that it has become increasingly unaffordable for the middle classes to enter the housing market.

Even though real estate in Northern Ireland has recovered quite a bit from the crash after the financial crisis, house prices are still cheap compared to cities in the country of Ireland. As one can see, prices in Belfast are barely half of residential real estate prices in Dublin.

The better affordability of Belfast compared to other cities on the island of Ireland opens up further opportunities for economic development. It could lead to an attraction of foreign talent. The Biden visit to Belfast this spring has the potential to attract an inflow of American foreign direct investment. The US president will surely be accompanied by a trade delegation. Belfast is well-placed to compete with Dublin, which is increasingly suffering from its recent successes.

The Republic of Ireland has seen a spectacular housing market boom. Dublin stands out as being one of the more unaffordable cities in Europe. The attraction of talent from abroad to work for global technology companies, many of which have their European headquarter in Dublin due to tax reasons, has contributed to the Irish growth miracle in recent years. At the same time, though, it has also led to an increase in prices for local services, and housing in particular, creating some discontent with the locals. Prices in Dublin are comparable to London now, and house price-to-income ratios across Irish cities in the Republic, in general, have surged.

Ireland might start suffering from a version of the Dutch disease where high wages in the tech and finance sector are driving up prices for the economy as a whole, making other industries less competitive. Belfast can thus position itself as a cheaper and more affordable alternative.

Conclusion

Northern Ireland’s economic recovery from the Covid recession has been smoother than that of Great Britain. Thanks to its position of having access to both the UK and EU common market, the region is uniquely positioned to perform better than the rest of Great Britain in the years to come. Ryanair recently announced it will open 15 new routes from Belfast International Airport, showing Belfast’s strong economic rise.

Northern Ireland is also well-placed to attract foreign FDI, particularly from US companies. And Belfast has two top-notch Universities. However, the biggest challenge for employers has been a skills shortage and a brain drain of talented people leaving for Ireland or Great Britain. Retaining talent in Northern Ireland will become easier now as the economic performance of the area is improving.

Julius Probst is the European labour economist with StepStone, the parent company of NIJobs. Before that, he was working as an application specialist for Macrobond Financial. He has a Master’s in Economics and a PhD in Economic History from Lund University in Sweden. During his PhD, he also worked as a researcher for the European Central Bank.