Drawing from an analysis 183,000 advertised job positions in Northern Ireland across 15 industries, NIJobs’ latest research uncovers salary and benefits trends shaping recruitment in 2026.

In this article, we’re taking a closet look at the findings and what they mean for employers navigating Northern Ireland’s labour market in 2026.

Key takeaways

* Pay remains the primary driver of job moves, with 51% of job switchers prioritising higher salaries and 47% of candidates are actively looking for a new role.

* Despite 46% of workers receiving pay increases this past year, 53% cut leisure spending and 33% cut essential spending.

* 59% of workers are satisfied with their salary, while 55% are satisfied with their current benefits.

* Flexibility is non-negotiable for many workers, with 40% ruling out roles that lack flexible working options.

* 82% of candidates avoid applying for roles that don’t include information around salary.

* The gender pay gap is narrowing but disparities persist across industries and in pay rise satisfaction.

Market updates: Economic conditions continues to shape pay and hiring

Northern Ireland’s labour market remains resilient, with employment at a record high and unemployment still among the lowest in the UK. As hiring remains active for 2026, employers are proceeding with greater caution as demand for skilled talent continues to shape pay decisions. Salary remains the primary drive of movement, making careful benchmarking essential for employers in a tighter, more selective market. Employers remain cautious, with many reporting that they scaled back plans to increase pay (33%), bonuses (25%), and benefit expressions (19%) in response to economic pressures.

The factors businesses reported as having a significant impact on their compensation decisions in the last 12 months include:

* Increased responsibility or promotion (50%)

* Inflation and rising cost of living (49%)

* Overall economic situation (45%)

These economic factors continues to dictate both employer and candidate salary decisions. Candidates are looking for higher salaries in 2025 while employers are increasing pay, particularly for skilled talent in industries such as construction, banking & finance and technology.

Salary trends across 2025

Our findings show that the advertised average gross median salary in 2025 for Northern Ireland reached £30,000.

When it comes to individual industries, Construction offered the highest advertised salary (£45,000) followed by Engineering (£41,500) and Healthcare (£40,000).

However, a different picture emerges when looking at salary growth. The fastest-growing industries in 2025 were:

* Banking & Finance (18%)

* Administration (10%)

* Hospitality (11%)

Overall, the Northern Ireland market shows a clear contrast between sectors offering the highest salaries and those experiencing the strongest pay growth.

While Construction and Engineering continue to lead on advertised pay due to ongoing demand for technical and project-based expertise, the fastest salary increases are emerging in traditionally lower-paid sectors.

In Banking & Finance, rising regulatory demands and competition for specialist skills are driving wage growth, while increases in Administration and Hospitality reflect employers responding to persistent recruitment challenges and retention pressures in a tight local labour market. Together, these trends underline the need for businesses to remain agile in their pay strategies as competition for talent intensifies across the region.

As a result, employers in these sectors are being forced to reassess renumeration strategies to attract and retain critical talent in an increasingly competitive market.

Salary satisfaction

Despite the rising cost of living, employee satisfaction was healthy in the past year, reaching 59%.

This is likely influenced by employers taking action on pay:

* 46% of workers received a pay rise last year

* 62% were satisfied with the increase they received

Despite this improvement, many employees are still under financial strain. Over half (53%) cut back on leisure spending last year, 33% reduced spending on essentials and 38% reported relying on savings and loans.

As a result, salary remains the single most important factor when considering a new role, as 51% cite higher pay as their main motivation for changing jobs. Looking ahead, 45% plan to earn or ask for a pay rise in 2026.

Northern Ireland’s gender pay gap in 2025

While it remains an issue, the gender pay gap in Northern Ireland remains largely unchanged and small in recent years at around 1.1% in 2025, calculated using hourly earnings in NI. (Office for National Statistics (ONS), employee earnings in the UK and Northern Ireland: 2025, October 2025.

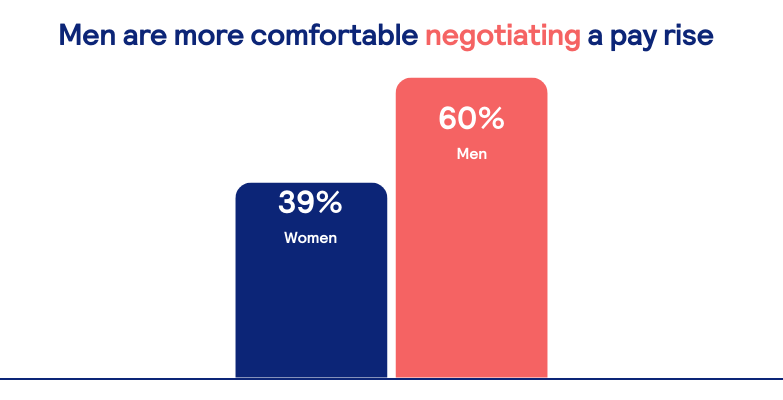

When it comes to negotiating, fewer women feel comfortable negotiating a pay rise and they also tend to see their market value as lower than men’s. 52% of men feel confident their salary reflects their current market value while only 47% of women feel the same. Over one third (35%) of women said their pay increase wasn’t enough to cover their current living expenses, while 40% said the raise didn’t reflect their work performance and commitment (compared to 35% of men).

The importance of salary transparency

Our findings show that salary transparency is set to be a vital trend in 2026 and beyond, and one that employers can’t afford to ignore.

Salary transparency is vital to appealing to talent, with candidates increasingly expecting compensation details upfront:

* 84% say a lack of salary information negatively impacts their opinion of an organisation.

* 72% avoid applying for roles with no salary information.

* 92% are more likely to apply for jobs when a salary range is listed.

From an employer perspective, a whopping 73% of recruiters say candidates drop out when salary expectations are discussed too late in the process. This can result in:

* Difficulty attracting top talent (49%)

* Higher recruitment costs (27%)

* Increased workload for current employees (23%)

Encouragingly, employers are starting to take action. 57% say they now consistently publish salary ranges and 23% are planning to in the near future.

Benefits trends across 2025

With salary growth under pressure across the Irish labour market, employers are increasingly using benefits to differentiate their employee value proposition and meet evolving candidate expectations.

Rather than relying on pay alone, organisations are prioritising benefits that support long-term financial security, flexibility, well-being and career development. Key benefits gaining momentum in Ireland include:

* Enhanced pension contributions above statutory minimums: This reflects growing employee focus on long-term financial well-being and retirement planning.

* Hybrid and remote working options: This has shifted from a competitive advantage to a baseline expectation, with flexibility now a key factor in job choice and retention.

* Mental health and well-being: This includes access to counselling, well-being programmes, and employee assistance services, as employers respond to increased awareness of burnout and work-related stress.

* Cycle to Work schemes: This continues to see strong uptake as a cost-effective benefit supporting financial savings, sustainability goals, and employee health.

* Learning, training, and development opportunities: These are increasingly viewed as critical to retention, as employees prioritise skills growth, career progression, and long-term employability.

As salary alone is no longer sufficient to attract and retain talent, employers that invest strategically in these benefits are better positioned to meet candidates expectations, strengthen engagement and remain competitive in the Irish market.

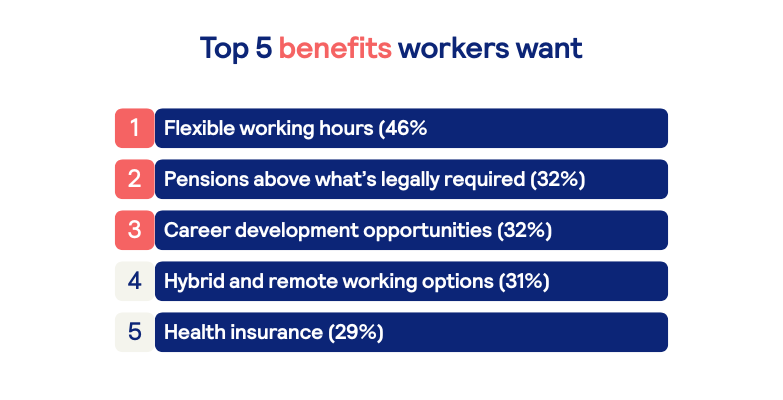

The most attractive benefits

Given the emphasis employees are placing on work-life balance, its unsurprising that health insurance (46%) is the most desirable benefits across the Northern Irish workforce.

Beyond talent attraction, providing this support also aids in the retention of existing staff members.

44% of workers that their current employer offers flexible working hours while 40% of workers say they wouldn’t apply for a role if it didn’t offer flexibility.

Benefits satisfaction

The latest research from NIJobs shows that 55% of workers are satisfied with their current benefits package.

This high level of satisfaction suggests employers are responding to worker preferences, particularly around work-life balance and flexibility. To maintain this trajectory moving forward, employers will need to continually evaluate their benefits packages, focusing on aligning offerings with the evolving needs of the workforce.

When it comes to business size, 61% of large business employees are satisfied with their benefits compared to 50% of SME employees.

Tips for employers

To successfully attract and retain the talent they need in 2026 and beyond, employers will need to carefully balance shifting candidate expectations with continuing economic challenges. Even as salary remains a key driver for candidates, transparency, flexibility, and targeted benefits are becoming non-negotiables.

Below, we’ve outlined some of the practical steps employers can take to stay competitive in the year ahead based on the findings of our research:

* Regulatory benchmark salaries: With 82% of candidates avoiding roles without salary information and 51% of job switchers prioritising higher pay, offering competitive, clearly positioned salaries is essential. Salary benchmarking against industry and regional averages can help ensure pay remains aligned with market expectations, particularly in high-demand sectors facing skills shortages. Regular benchmarking also supports more confident salary conversations and helps reduce candidate drop-offs.

* Use pay reviews strategically: While 46% of workers received a pay rise in 2025, financial pressure remains widespread, and 47% actively looking for a new role. Regular, structured pay reviews, even where large increases aren’t possible, can help retain talent by demonstrating progression and fairness.

* Be transparent about salary: Salary transparency is no longer just a “nice-to-have”. With 92% of candidates more likely to apply when a salary range is listed, and 73% of recruiters reporting drop-offs when pay is discussed too late, publishing salary information is now not a nice-to-have, its a must. Transparency helps manage expectations, shortens time to hire and reduces wasted resources on misaligned applications.

* Strengthen benefits to offset salary pressure: As employers struggle to meet salary demands, benefits are increasingly important in attracting and retaining talent. Workers are prioritising flexible hours, enhanced pensions, sick pay, and hybrid working, while demand for health and well-being support is rising. Reviewing and clearly promoting benefits can help employers remain competitive in the search for talent even when salary increases are limited.

* Embed flexibility where possible: Well-being and flexibility are now a deal-breaker for workers in Northern Ireland, while work-life balance is the top career goal for employees outside of salary in 2026. Employers that can offer health insurance, flexible hours, and hybrid/remote working options are better positioned to attract a broader talent pool and retain experienced employees. Even partial flexibility can significantly improve an employer’s appeal, particularly in a market where financial uncertainty continues to influence worker behaviour.

About our research

Our data comes from OTT, an in-house job-ad analysis tool built by The Stepstone Group, which analyses job postings and associated data such as salaries, location, skills, and benefits. We analysed 283,000 Northern Irish job ads collected between 2019 and 2025, covering 15 industries. Salary and benefits data were extracted in November 2025 to provide a consistent view of how advertised pay and benefits have evolved over time. Using this dataset, we calculated the advertised gross median salary per industry.

Insights from a worker and employer perspective come from two NI surveys conducted between 18 November and 26 November 2025. The worker survey captured responses from 500 NI workers and was weighted to be representative of Northern Ireland’s workforce by age, gender, and region. The recruiters survey gathered responses from 150 recruiters and HR professionals. Sampling and weighting were aligned with previous years to ensure comparability, with industry-level boosts applied to ensure robust representation across all sectors analysed.