NIJobs predicts 2022 will be another strong year for jobseekers but say businesses must adapt quickly and invest in order to tackle ongoing employment challenges.

The latest ‘NIJobs Job Report’ with Ulster Bank notes a bumper year for recruitment activity in 2021. Taken in tandem with the recent NISRA labour market figures which revealed that employee numbers in Northern Ireland are now at a record high, it suggests that 2022 is shaping up to be a ferociously competitive talent market for employers.

The NIJobs Job Report tracks hiring activity in NI by analysing the platform’s job data, giving an indication of likely trends for the year ahead so businesses can plan their recruitment strategy accordingly.

Jump in HR roles

NIJobs data reveals jobs in Human Resources were two and half times higher (150%) in the final three months of 2021 compared to the same period a year earlier. This rise suggests employers are moving to put the necessary internal resources in place to support and advance their recruitment and retention ambitions for the year ahead.

28 of the 31 employment categories posted an increase in job listings with 23 listings a record high of vacancies. Encouragingly, 24 categories had listings in 2021 above pre-pandemic levels in 2019.

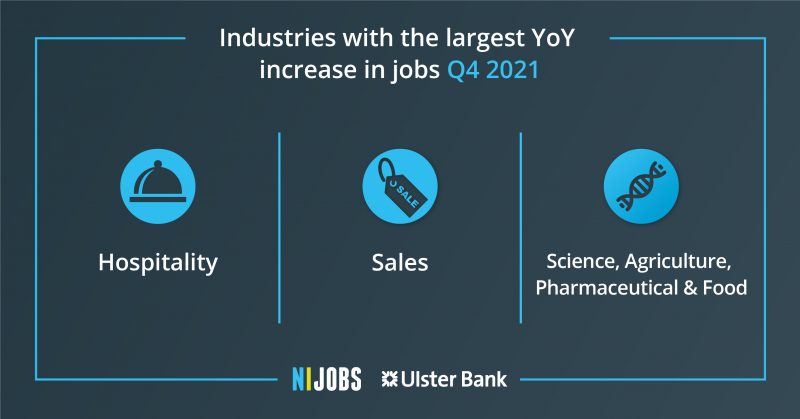

Nursing, Healthcare & Medical; Hospitality, IT; Accountancy & Finance; and Sales roles occupied the top five recruitment categories and accounted for almost half of all recruitment activity. Nursing, Healthcare & Medical and Hospitality were ranked the top two employment categories for recruitment activity. Almost 1 in 10 of all listings were within the Hospitality sector. Nursing, Healthcare & Medical and Hospitality are expected to top the recruitment rankings in 2022.

Data indicates there are more jobs than ever, but skills shortages remain in an increasingly candidate-driven market where potential employees can be more selective in job applications and dictate their worth.

The recruitment landscape has shifted significantly during the last 18 months. It has adapted in a fast-paced environment to support a whole new way of working with more HR roles are being created to support overall demand.

Fast paced job market

Sam McIlveen, General Manager at NIJobs says: “HR roles have increased by more than 150% compared to the same time last year. It indicates that companies now recognise the need to address the current challenges they face.

“Recent figures from NISRA note that there are almost 800,000 payrolled employees in NI, so more people are in work. While at the same time there are now more jobs than ever available. It means employers will be forced to work even harder to attract talent. This is the new reality for recruitment, a fact acknowledged earlier this month in a survey from Manufacturing NI which reported that 60% of their firms said access to labour was the biggest issue.

“It is likely employers will battle for talent in 2022 and beyond. Hiring will be an ongoing challenge and businesses need to resolve this issue creatively. The HR function of any business is vital and, since the pandemic, its responsibilities have grown considerably from managing public health advice to planning remote working strategies as well as keeping employees engaged.

“As we look ahead, retention is going to be a big focus for businesses as employees will consider their career options during the first quarter of 2022. Employee engagement has never been more important so identifying the needs and rewarding employees is key to retaining talent. Every sector will differ, but employees want more fulfilment in their career now and don’t rely solely on job/financial security.

“As businesses fight it out for talent, candidates are more selective in jobs they are applying for, and employer branding is another area to consider. A ‘great place to work’ will no longer cut it so get creative in your USP with what you can offer. Sectors such as IT, manufacturing and engineering remain in demand and recruitment needs to offer bespoke packages and perks for all employees to help your business grow.

“Companies must have the ability to adapt and deliver for existing and new employees within this fast-paced job market in the post-pandemic world.”

Cost of living

The NIJobs.com Job Report with Ulster Bank offers respected insight into the recruitment trends, economic environment and the types of roles jobseekers are searching for online.

Ulster Bank’s Chief Economist Richard Ramsey believes 2021 was a year to remember but 2022 is likely to be another strong year for recruitment due to the anticipated high levels of staff turnover as people chase higher salaries.

2021 Review

“The pandemic triggered a slump in activity within the recruitment market in 2020. Fears of a surge in unemployment after the removal of the Job Retention Scheme have not come to pass. Instead, payroll numbers and unemployment have diverged in the right directions.

“As far as signs of stress in the labour market are concerned, the most visible are those of the positive variety, namely skills shortages rather than job losses. Redundancies in 2021 were a fraction of what they were in 2020 and the recruitment market is characterised by record numbers of job vacancies.

“The latest NIJobs.com Jobs Report revealed another strong quarter in Q4 to top a record year for advertised vacancies. Perhaps not surprisingly, the Q4 recruitment drive eased back by 10% from the surge in the previous quarter following the lifting of lockdown restrictions. 21 of the 31 employment categories reported fewer listings in Q4 relative to the previous quarter.

The slowdown was most evident within the hospitality sector (-40% q/q) as many of the recent job openings become filled. The hospitality industry was also the most disrupted from the resurgence of COVID-19 infections and the arrival of the Omicron variant which triggered a Mexican-wave of booking cancellations over the festive period.

“Nevertheless, four categories ended 2021 on a high. Motoring, Engineering and Secretarial and Admin postings all posted record highs in Q4. Hiring within the motoring trades is gearing up after dealers experienced the worst two years for new car sales on record. 2022 can only get better. The Secretarial and Admin sector recorded a significant number of job losses and churn during 2020 following the shift towards a working from home business model. As such, the hiring surge is coming off a low base. Meanwhile, the Banking, Financial Services and Insurance sector posted a joint-record high in Q4.

“There were seven times as many job listings within the Nursing, Healthcare and Medical sectors in 2021 relative to 2019. This highlights the scale of attrition within the health service and the difficulty in filling vacancies. Nursing, Health, and Medical’s share of the market has more than quadrupled since 2019 from almost 5% to 21% in 2021.This industry has also suffered from an exodus of EU nationals following Brexit, as has the Hospitality sector.

“While the surge in growth in some sectors such as Nursing is linked to high levels of staff turnover, other sectors are hiring due to expansion. This is particularly apparent within the Science, Agriculture, Pharma and Food industry which saw its listings increase six-fold over the last year (and doubled relative to 2019). A number of flagship firms in the pharma industry have announced significant plans for expansion. Pharma recruitment is expected to remain strong in 2022. Brexit has been a double-edged sword for the agri-food industry. Many firms have benefited from a surge in demand from the Republic of Ireland but have suffered from the loss of EU national workers.

Looking ahead

“The evolving cost-of-living crisis will be the dominant economic story this year. People cannot control the cost of living but they will become more sensitive to rates of pay. With incomes squeezed, the demand for more significant pay rises from employers will intensify. For some sectors, such as the Hospitality sector which already faced a recovery roller-coaster, rising wage and energy costs presents a significant challenge. For workers, moving jobs may be their only way to secure a meaningful pay rise in the face of the rising cost of living.

“It should be remembered that households and businesses also face a major hike in National Insurance Contributions in April. Hopes of a ‘U-turn’ or deferral on this front in the forthcoming 23rd March budget is perhaps wishful thinking. The combined inflationary and tax squeeze will impact consumer spending and those sectors and jobs, such as retail and hospitality, that are reliant on it.”

NIJobs.com has been helping people climb the career ladder since 2000. Our team is brimming with tips, guidance, ideas and inspiration, seeking to bring you closer to your dream job.